Yureplex.com Review: How the Platform Structures Forex and CFD Trading Access

Online brokers often look similar at first glance, but the details usually sit in the offer: what can actually be traded, how the platform is accessed, and what the account tiers unlock. This Yureplex.com Review approaches the platform through that lens, with a specific focus on its Forex and CFD setup, the way the account ladder is presented, and how the web-based environment is positioned for everyday trading use.

Instead of leaning on broad claims, the review focuses strictly on what is shown and described on the platform’s public pages. Yureplex is assessed based on its published account tier panels, the “Why Us” section, and the explanations provided around pricing and platform structure.

Forex and CFD Trading Access Overview

What Platform Features Are Available to Forex and CFD Users?

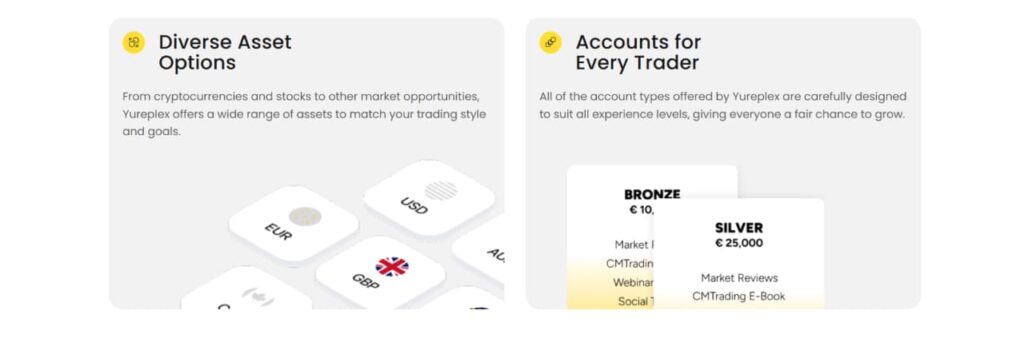

At its core, Yureplex is presented as a broker environment where trading is executed through CFDs, including Forex pairs and other markets displayed as derivative instruments. The offer is framed around access to multiple categories from one place, which is often the deciding factor for traders who want to move between currency pairs, indices, commodities, equities, and crypto-based instruments without maintaining separate accounts.

A practical way to interpret the offering is that Yureplex aims to provide a single workflow for CFD trading, with Forex as the anchor market. That matters because many traders build routines around currencies first, then layer in other instruments when volatility, macro events, or portfolio balance calls for it.

What Forex and CFD Markets Are Covered by the Platform?

The platform’s public positioning emphasizes breadth and ongoing expansion of instruments. Forex is described as a core market, supported by CFD access to other categories such as stocks, indices, commodities, and cryptocurrencies.

That mix tends to suit traders who build strategies around correlation and rotation. Currency moves can be paired with index direction, commodities can be used for macro hedging themes, and crypto CFDs can provide weekend market activity when traditional instruments are closed.

This Yureplex.com Review treats that multi-market scope as a foundational part of the offer, because it shapes how the platform is likely to be used in real conditions: less as a single-instrument terminal and more as a dashboard for cross-market opportunities.

Trading Environment and Execution Model

How Is Trading Executed Within the Platform Environment?

Yureplex is positioned as a web-based trading platform, which means access is designed to happen through a browser without installation. This detail is not cosmetic. It affects how traders manage consistency across devices and how quickly the platform can be opened during active market windows.

The platform messaging also emphasizes speed and smooth navigation, which is typically a response to the biggest daily pain point in browser environments: interface friction. A web-first approach generally suits traders who want fast access from different devices, rather than those who prefer heavy desktop customization.

In practical usage terms, a typical trading session on a web platform like this often starts with quick market scanning, checking open positions, and switching between charts without needing a separate app or update cycle.

Which Platform Tools Support Forex and CFD Decision-Making?

Yureplex highlights tools intended to help traders interpret markets rather than outsource decisions. As outlined in this Yureplex.com Review, the platform presentation leans into market reviews, charting visibility, and learning resources that can be used alongside live price monitoring.

The account panels also reference add-ons such as webinar access, social trading features, and video-on-demand content at higher tiers. These elements suggest the platform is designed to support both self-directed execution and guided learning, especially for traders moving from basic Forex positions into broader CFD exposure.

A clear theme is that tools are framed as part of the environment rather than separated into disconnected “education” and “trading” silos. This approach often appeals to traders who prefer one consistent place for chart review, market context, and execution.

Account Structure and Tier Progression

How Is the Account Tier Structure Organized, and What Does Each Level Include?

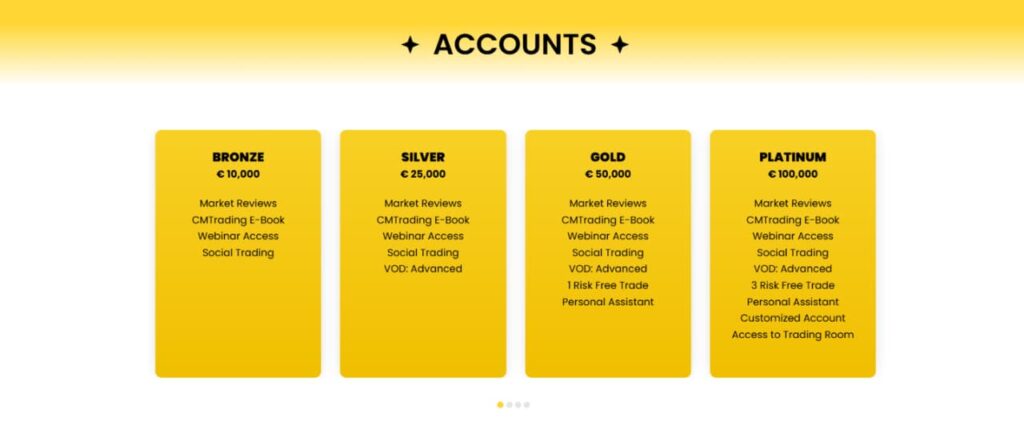

| Account Tier | Minimum Deposit | How the Tier Is Positioned | Included Access Signals |

| Bronze | €10,000 | Entry-level access for traders starting with live Forex and CFD exposure | Market reviews, core learning materials, introductory platform access |

| Silver | €25,000 | Expanded learning and engagement layer beyond basic trading | Market reviews, e-book resources, webinar access, social trading features |

| Gold | €50,000 | Transition tier for traders seeking deeper market interaction | Advanced webinars, enhanced learning content, limited risk-free trade entries |

| Platinum | €100,000 | Structured trading support with broader platform involvement | Advanced VOD content, multiple risk-free trade entries, personalized account interaction |

| Diamond | €250,000 | Higher-tier environment focused on tailored trading support | Dedicated account roles, extended content access, increased platform privileges |

| Premium | €500,000 | Professional-style setup emphasizing customization and access | Trading specialist interaction, advanced reviews, priority-level resources |

| VIP | €1,000,000 | Top-tier configuration designed for high-capital trading workflows | Full account customization, senior-level support access, maximum feature availability |

From an offer perspective, the tier ladder communicates two clear intentions. First, education and platform access are packaged to expand progressively, with additional tools, learning formats, and support elements unlocking as account levels increase. Second, higher tiers are framed as more assisted and more tailored, which can appeal to traders who prefer a stronger service layer as position size and trading activity grow.

Alongside this progression model, the platform also presents a separate Islamic account option. Rather than sitting within the tier hierarchy, it is positioned as an alternative structure built around a swap-free format with no interest applied to overnight positions.

The account references access to core features such as market reviews, webinars, and social trading, suggesting that it operates within the same Forex and CFD environment while accommodating traders who require this account type.

Fees, Costs, and Transaction Handling

How Are CFD Trading Fees and Costs Presented on the Platform?

Costs are described in a way that prioritizes clarity rather than complexity. As outlined in this Yureplex.com Review, spreads are presented as the primary cost component, with commissions generally not applied unless stated otherwise. The platform also references deposit and withdrawal handling terms, including conditions around monthly free transactions and the possibility of bank-side charges.

From a Forex and CFD perspective, spread visibility matters more than marketing language. Traders typically assess whether spreads remain predictable during normal market sessions and whether pricing is displayed clearly enough to support realistic pre-trade planning.

Swap or overnight holding fees are also referenced as a possible consideration, which is a standard structural element in CFD trading environments. In practice, this encourages traders to plan holding periods carefully and distinguish between strategies built for intraday execution and those intended for multi-day positions.

How Are Funding and Withdrawals Processed on the Platform?

Yureplex describes funding via card payments, bank transfers, and selected online payment options depending on location. Processing time expectations are separated by method, with card and online payments often described as faster than bank transfers.

Withdrawals are described as following a request-and-processing flow rather than being positioned as instant. This matters because traders often plan withdrawals around trading cycles, margin usage, and calendar events.

This Yureplex.com Review treats those mechanics as part of the offer because deposit and withdrawal clarity is not a “support detail.” It shapes how traders manage capital timing, particularly when shifting between Forex and higher-volatility CFD instruments.

Platform Evaluation and Trade-Off Analysis

What Are the Key Strengths and Trade-Offs of the Forex and CFD Offering?

Yureplex’s offer is strongest where it stays structured. The web-based access supports device flexibility, the tier model explains progression clearly, and the platform’s CFD framing allows multi-market participation from one environment. Forex is treated as a central market, while other CFDs expand the scope for traders who prefer rotation strategies.

Overall, this Yureplex.com Review frames these as usability decisions rather than red flags, because they align with the platform’s stated goal of making trading more accessible and structured.

Key Takeaways From the Platform Review

This Yureplex.com Review examined the platform primarily through the lens that matters most to many traders: the Forex and CFD offer itself. The platform is presented as a web-based CFD broker with Forex at the center, supported by access to additional markets, a tiered account ladder, and integrated resources that scale as account levels change.

For traders who value a structured setup, cross-market CFD access, and a platform designed for browser-based continuity, the overall offer is clearly defined. The analysis suggests the strongest fit is for traders who prefer a guided progression model while keeping execution self-directed inside a single web environment.